Are you willing to pay millions of dollars for a meme or an artwork? What if you could buy a social media post by your favourite celebrity? Earlier this year, Twitter CEO Jack Dorsey, to celebrate the 15th anniversary of his first tweet, put up the digitally autographed version of this tweet for an auction as an NFT. Two weeks later, his tweet was sold for $2.9 million to a Malaysian blockchain CEO, who compared the value of the NFT to Mona Lisa’s painting. The auction made headlines, and experts knew that 2021 will be the iconic year of the crypto movement changing the digital art space and popular culture. While most of us are still trying to understand the nitty-gritty of crypto trading, NFTs (non-fungible tokens) have started contributing millions to the crypto art market already.

What is an NFT?

How about adding Amitabh Bachchan’s audio recital of his father’s legendary poem, Madhushala, to your collection? How about owning the digital version of your favourite sneaker collection as an NFT? The Nyan Cat that was an internet sensation back in 2011 resurfaced this year and broke records when the meme version of this cat was auctioned and sold as an NFT for $590,000. A price this high for digital, but an original version! Welcome to the world of NFTs, the world of digital disruption.

• Non-fungible tokens, popularly known as NFTs comprise digital assets like art, music, videos, audios, games or anything and everything that can be bought and sold digitally in exchange for cryptocurrencies.

• An NFT is a unique digital token or a digital certificate that represents the ownership of a digital asset authenticated by blockchains.

• Each NFT has a unique code that signifies its authenticity.

• An NFT of a particular digital asset can be traded on specific NFT platforms in exchange for cryptocurrencies.

• An NFT can have only one owner at a time.

• An NFT is as authentic as the original copy.

• For example, if you buy an NFT of a sneaker collection, you will be the owner of the digital version of the NFT instead of the actual sneakers.

The difference between Fungible and Non-fungible

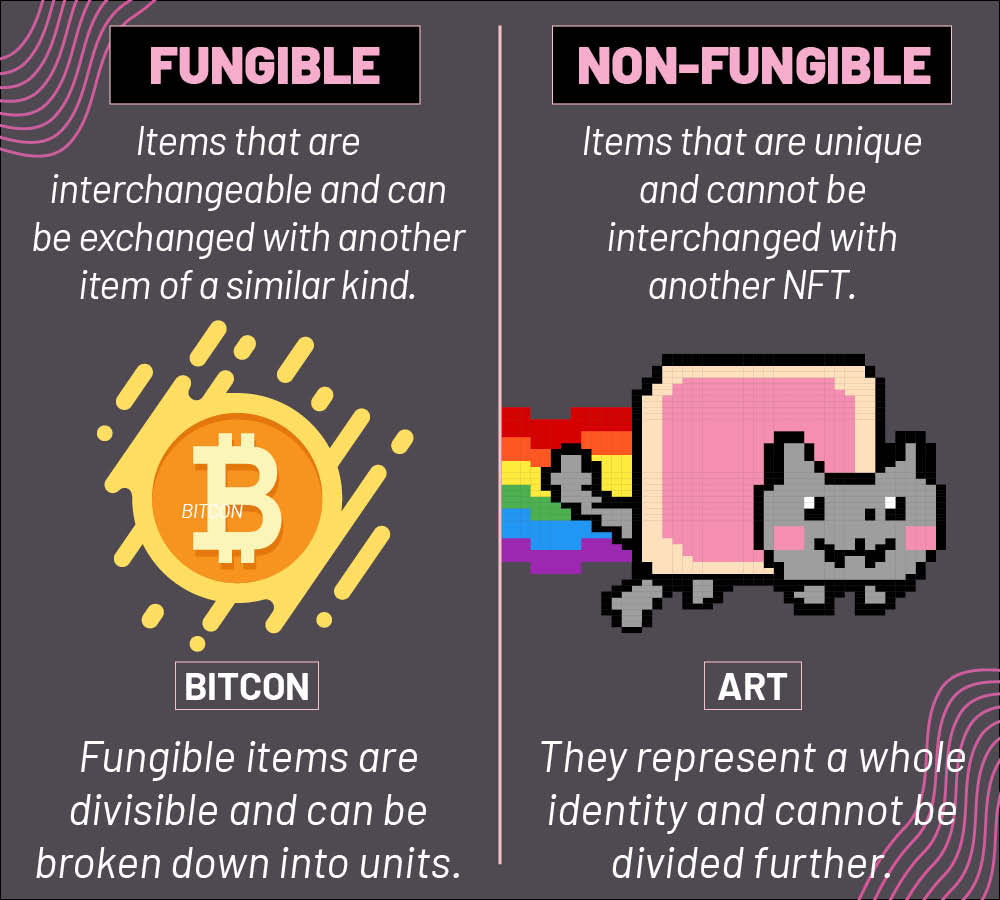

To understand the sudden hype around non-fungible tokens, let’s try to grasp the basics of fungible and non-fungible concepts. Goods and commodities that are indistinguishable and can be exchanged or substituted are fungible. Neha Srinivasan, Vice President, Strategy and Finance, Reliance Foundation, explains the concept of fungibility in simple words. The concept of fungibility, according to her, applies to a group of goods where every member is identical and can be exchanged or traded with one another because they are not unique when compared to each other. Cryptocurrencies are common examples of fungible tokens; they are equal in value and can be traded for one another. However, they may be some unique cryptocurrencies.

Srinivasan also explains that digital money is fungible. Physical money is often considered semi-fungible. The value of a ₹200 note that you own is the same as the value of a ₹200 rupee note owned by your friend. And, you can exchange this note with two separate ₹100 notes because the value will not change.

Non-fungible goods cannot be substituted or exchanged. For example, a diamond cannot be exchanged with another because the quality, colour and cut of every diamond are different. Each NFT is unique and different, Srinivasan adds. An NFT can be bought or sold, but it cannot be exchanged with another one. With regards to tokens, a non-fungible token is definitely unique to itself. An NFT entails that only one copy was created or minted when it was added to the blockchain, she explains.

Is it safe to invest in an NFT?

Cryptocurrencies around the world exist in the grey area between regulated currencies and open financial markets. India has adopted a conservative approach to crypto. So far, there has not been any official announcements about the regulation of crypto in Indian markets. India is on its way to the hub for the next NFT art wave, explains Srinivasan.

NFTs are relatively new, and there's a lot to explore and understand. It might be difficult at present to understand the rationale behind the price of a piece of digital art. NFTs are an interesting new type of investment, but they might not be right for everyone. It's best to watch this phenomenon unfold from the sidelines where your money is safer, she advises.

Are NFTs a FAD?

While the NFT trend has been gaining momentum worldwide for a while now, Indian artists have joined the bandwagon to gain the first-mover advantage here. Actor Sunny Leone will soon be launching her collection of animated art NFTs on her NFT website. Actor Amitabh Bachchan’s NFT collection is expected to go on auction this November. Indian Super League is on its way to being the first Indian sports league to launch exclusive non-fungible tokens as digital collectables. Fans can engage with their favourite athletes and teams with such digital collectables. There’s definitely a ‘bragworthy’ value attached to such NFTs.

As explained very simply by Srinivasan, the demand for the non-fungible token will continue to grow with innovations coming into play. Blockchains need to develop a more environment-efficient process around the creation of NFTs.

NFTs require massive energy consumption. French artist Joanie Lemercier sold a set of six NFTs on Nifty Gateway for several thousand dollars in a matter of seconds. The energy required to complete the sale was a massive 8.7 megawatt-hours (MWh). The high energy consumption by digital currencies and NFTs is a cause of concern around the world. The high carbon footprints of NFTs and cryptocurrencies are being debated, discussed and evaluated constantly to device sustainable alternatives

Gone are the days when you had to visit an art gallery to buy an original painting by your favourite artist. In a post-pandemic world, the future of NFTs is hard to predict. Fad or fantastic, only time will tell. With no specific laws regulating the trading of NFTs in India, the future appears both uncertain and positive. Digital content creators are ecstatic because NFTs will authenticate and provide proof of ownership and records of purchases. Experts believe that this new trend will resolve the problem of duplication and provenance eventually; a much-needed requirement for art and artists. Will this digital disruption change things for good? Let’s wait and watch.

It is recommended to consult a professional to understand the environmental impacts, investment options and risk advice.